Our most recent episode of The Polestar Podcast by VELA Wealth features Kori Chilibeck and Matt Moreau, founders of the social enterprise The Earth Group. The Earth Group exists entirely to provide school meals to children globally through a worldwide agreement with The United Nations World Food Programme (WFP).

Hosted by Rob Wallis, Kori and Matt will share the journey of the Earth Group, its social initiatives and business model, challenges they faced during the pandemic, difficulties they experience while building new relationships with well-known brands, and their successful stories on changing minds and lives.

About the Guest – Kori Chilibeck and Matt Moreau

Kori Chilibeck and Matt Moreau met in 2005 while working at Skiers Sportshop in Edmonton, Canada. Through extensive travel their eyes were opened to the dire circumstances in which a large percentage of the world lives. This instilled a sense of responsibility to do what they could to create positive change in the lives of people who need it most. In 2005 Matt and Kori started a social enterprise called Earth Water and donated 100% of their net profits to the United Nations World Food Programme. Please visit The Earth Group website to learn more.

About the Host – Rob Wallis

Rob has been providing expert planning and strategic advice for nearly 20 years, and has been with VELA Wealth since 2016. Rob excels at working with entrepreneurial professionals and business owners to define their individual ecosystems and establish meaningful life and financial goals. A methodical and analytical thinker, Rob compassionately navigates clients through the complexities of a thorough financial planning process ensuring that they feel understood and supported throughout. To read more, please visit the VELA team page.

The episode is also available on:

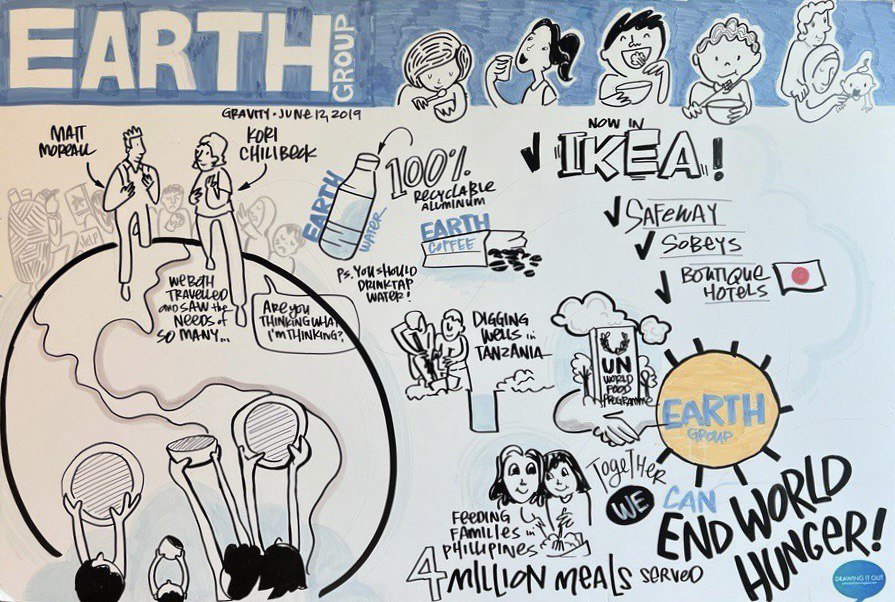

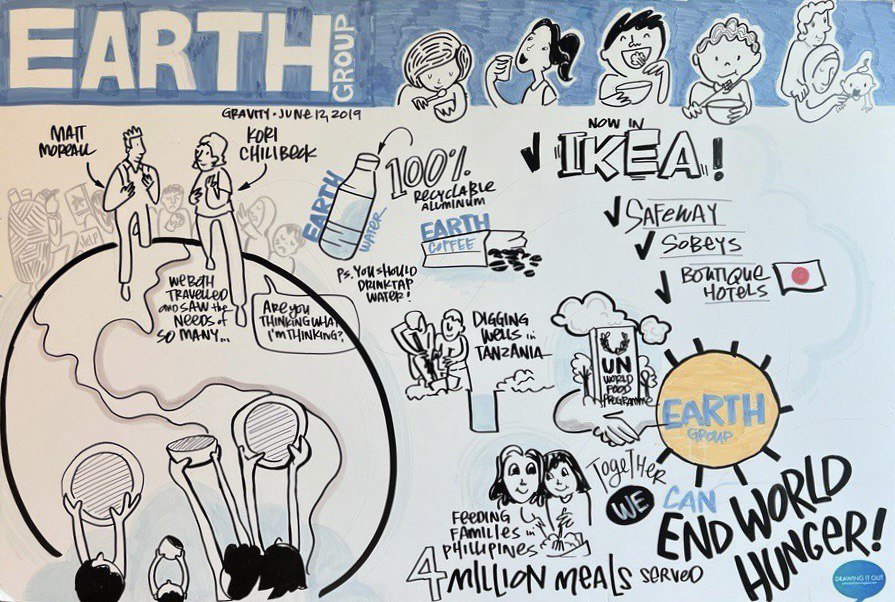

Live-drawn board performed during the Gravity 2019 event in Vancouver.

The Podcast Transcript

Rob Wallis:

Hi, welcome to The VELA Wealth Polestar Podcast. Today we have the pleasure of having Matt Moreau and Kori Chilibeck from the Earth Group. We will be talking about their business and what they’re up to in the world.

We have the pleasure of welcoming these guys to our Gravity event, when we did in-person events back in 2019. It is incredible as it was over three years ago and how much the world has changed and moved on in that time.

It’s pleasure to have you back, and welcome. Before we jump in, could you tell us a little bit about the Earth Group? And then we’ll get rolling from there.

Kori Chilibeck :

Sure! The Earth Group is a social enterprise that right now sells water, coffee and tea in various countries all over the world. We use our profits to provide food, water and education to some of the poorest children on the planet through our partner, the United Nations World Food Program.

Rob Wallis:

I’m just looking at the board that we had live-drawn when you were in Vancouver in 2019 and it says you guys had four million meals served. How many meals have you had to that now?

Matt Moreau:

By the end of this year, we’ll probably be sitting about the four and a half million mark. Can get into it, but COVID certainly put a damper on things for us. We had to switch our model the year that COVID hit in 2020 and did a program locally and funded 50,000 meals for people here in the City of Edmonton with the local food banks.

Rob Wallis:

Got it. So, let’s talk about Covid. How was that for the Earth Group?

Kori Chilibeck:

It was, uh… it was devastating and it happened quickly. I remember Matt and I were sitting at the office, looking at revenue for the month and I think it was one of the worst months we’ve ever had since we ran the company out of an old van. It was bad. It got back quickly too. What are your thoughts on that Matt? Sorry, I might be exaggerating.

Matt Moreau:

Not at all. 85 percent of the revenue disappeared overnight. We were very heavily invested in channels such as hotels, cafes and restaurants, catering companies and airlines. And all these things just basically disappeared overnight. So, it certainly put the fear of God in us for a little right there.

Kori Chilibeck:

Yes, we actually had a contract with Hilton Hotels in Japan going through the Olympics. Obviously, the Olympics got cancelled and pushed a year. Then, when it actually happened, all the hotels were empty because they didn’t allow anybody in the country. So instead of potentially the best year we had ever had on record, it ended up being one of the worst.

Rob Wallis:

And how were regular retail sales during that time?

Matt Moreau:

Most of that disappeared as well. If we’re talking about regular grocery stores, people that used to walk into a store, grab a sandwich and a bottle of water, and head back to their office just weren’t doing that anymore.

So, our product is never going to sell in a 24 pack. We’re not here to compete with Nestle. So, that was the only water product that was moving in these stores, and we saw a lot of single use stuff in the lunch out disappear as well.

Rob Wallis:

Crazy. How it is now?

Kori Chilibeck:

Well, things have changed a lot. Again, it just happened all of a sudden: really picked up and I would say we probably had our busiest six months that we’ve ever had as a company right now.

Matt Moreau:

Yes, we’ve picked up. Speaking for myself, a few months there was kind of feeling of sorrow and I was terrified of what was going to happen with the business and everything. Then we just sort of dusted ourselves off and started finding spots that were still open and knocking on doors that were still in business. Places such as cafes, party bakeries were one of those spots.

Fast forward to today, we’re just starting a nationwide launch with all the Cobs bakeries across the country. The film and television industry were still operating, and they were really looking for a product that had a story for social enterprises support. So, we picked up a lot of great new business there.

With these new distribution channels and then everything else coming back online as far as the catering companies in the hotels and so forth, as Kori says, things are going really well right now.

Kori Chilibeck:

I think during COVID we had a lot of time to plan and find other avenues that we hadn’t explored. We were thinking about anything and everything. So, I think after two years of working the phone, sending e-mails, sending samples, trying to grow business when the world turned back on again. We had all these leads out there that just all the sudden started coming together all at once. So, it was nice.

Rob Wallis:

Great. And were you able to maintain relationships with the bigger companies such as Hilton?

Kori Chilibeck:

Well, Hilton is tricky because there are a lot of factors. One, it was in Japan and the Canadian dollar increased over COVID by about 16-17% against the Yen. So, we just became more expensive over COVID by quite a bit. Then, with the shipping situation globally including huge increases in shipping, we just became a very expensive product outside of Canada. Even with inside of Canada shipping has been difficult. The prices are starting to come down now and we probably ended up landing almost 30% more in Tokyo than we were before COVID.

So, it really put a damper on sales in that part of the world right now. We’re hoping that’s going to come back now and that things are starting to normalize a little bit.

Rob Wallis:

So, in terms of the story, what is the story of the Earth Group? How did you come up with the concept and what was the journey from there to where you are now?

Kori Chilibeck:

Well, it started as a spoiled kid growing up in Edmonton, realizing that the world was not what I thought it was. I went to university at the U of A, played hockey, went on family ski trips, didn’t really realize that 90% of the world wasn’t living the same lifestyle I was.

I had taken a year off of school, I was on a Mount Everest basecamp expedition with my girlfriend, now wife, and we were going up towards basecamp dressed as your typical North American tourists, wearing big North Face down, puffy outfit on, and there’s a kid behind me carrying three people’s backpacks and heading up towards basecamp. And we passed this old man on the trail, who was going the same direction as us, and he had a big woven basket on his back. He was totally barefoot, no gloves, no hat, no jacket, just like some ripped pants and an old shirt, and we asked him what he was carrying. He says, “I get paid $0.25 US a day to carry this basket, I don’t really know what the items are and it’s not something I can afford”. When we looked inside the basket, it was just cans of Coca-Cola.

So, at that point I started to realize that either directly or maybe indirectly, some of the biggest companies in the planet were making money literally off the backs of the poorest people in the world.

So, came back to Edmonton and thought, well, why couldn’t you have a company that could compete against the biggest brands and biggest companies in the world? But at the end of the day, we would give back to people who really, really needed it. So, that was sort of the idea of the company in the very early days.

Rob Wallis:

Got it. I’m seeing you two drink bottles of the Earth Water right now, and it’s in aluminium or aluminum for our North American listeners. What was the impetus for choosing aluminum as a material of choice for the water?

Matt Moreau:

Kori and I are probably the only owners of a bottled water company that encouraged people, not to drink bottled water. For the most part, we’re very lucky here in Canada to be able to go to a tap and fill up from there.

So, we’re aware that we’re creating an impact on the planet through our operations and that single use plastic is a major global issue. So, we were looking at things thinking, how can we lessen our impact on the planet’s a little bit? We found out that aluminum gets recycled at a much higher rate than plastic and takes less energy to recycle. So, we got these fully reusable and recyclable aluminum cans that can be rinsed out, resealed, and used over and over again.

And I think that’s been a big kind of boom to our success as well through COVID. We made that transition basically a couple months before COVID hit and then had the last couple years to tell that story to people about how we have this product that is lessening the impact on the planet and just has a little bit of usability to it.

Rob Wallis:

Can you please tell us why aluminum has a higher recycle rate than plastic?

Kori Chilibeck:

I think there’s a couple reasons. In Canada, a lot of things changed since the 50s, when they started putting beer in aluminum cans. The beer industry created a really good recycling programs with the deposit on it. There is a value to aluminum whereas plastic is a bit of a false value. We put a value on it through the deposit system whereas aluminum is a commodity that’s traded on the open market. I think that stat is 70% of all aluminum ever created since the beginning of time is still being used today. So, it’s an amazing product that way.

So, the actual facilities do recycle because there is an actual market for the recycled material. Whereas with plastic it’s difficult to utilize recycled plastic and even trying to make other plastic bottles out of recycled plastic bottles creates a lot of energy and a lot of waste doing that. Whereas aluminum is just that much better. It’s exponentially better.

Rob Wallis:

Got it. What is your first product?

Matt Moreau:

The Earth Water was the first product. Sort of a water for a water idea.

By buying Earth Water you could provide water relief for someone somewhere in the world whether that was digging distribution points or wells or so forth in refugee camps.

As we’ve grown into coffee and tea and a little bit of apparel, that message has expanded from just providing water relief to funding school meal programs as well.

Rob Wallis:

And the other products that you’ve launched are coffee and tea, have I missed one?

Matt Moreau:

We do a little bit of apparel. For example, we were just sponsoring the Edmonton Folk Music Festival last weekend and we have hats and T-shirts and things like that. So, a little bit of that on our online store as well.

We’re really hoping, I would say in early 2023, to have some sparkling water and flavored sparkling waters as well. Kori’s got some other product threat perhaps on the go here as well.

Kori Chilibeck:

Yeah, I was trying to diversify the product line a little bit. We’re changing up our packaging over the next months, hopefully early in the New Year. We’re trying to get more sustainable and do different things. There’s always a way to make things better because we’re a small company, we’re able to switch to new packaging quickly. Whatever the next greatest thing that comes along that’s more sustainable, benefit environment and maybe caught more cost effective – we can look at that immediately because we don’t own $100 million production lines that we’re able to switch over to something better.

Rob Wallis:

So how do you use the Earth Group to help the planet?

Matt Moreau:

Our main focus is school meal program. So, kids are given a safe place to go during the day, free food, free water and then provided that all important free education. So, better educated kids grow up to have higher earning potential, they’ll have less kids on average and they’ll make it to university. Effects of these school meal programs are enormous.

Rob Wallis:

Right, and how do people that need your help find you?

Kori Chilibeck:

Well, we really work closely with our partner, the United Nations World Food Program. So, they’re the experts, not us. We work in Edmonton majority of the time and we’re just not out in the field doing that. We’re really honored to work with some of the most passionate people on the planet. Essentially, they come to us every year and give us sort of a list of three or four places in the world that have the greatest need in their eyes. We work with them and fund projects that we feel that we can make an impact on, and we do try to do a project every year somewhere else in the world. For example, Tajikistan, Bolivia and then the Philippines. It depends on what’s happening in the world.

Also, and we do try to focus on places that aren’t in the public eye a lot. We try to focus on places that are sort of the world’s bit forgotten, but still need a lot of help.

Rob Wallis:

Could you give us an example of that?

Kori Chilibeck:

Sure. We did a project in Bolivia which is the poorest country in the Latin America. There was very little aid going into the country. Their school meal projects were actually about to be shut down before we came in there. They were running out of funds and we thought this was a great place for us to go in and help. So, I think we funded 500,000 meals in Bolivia.

Rob Wallis:

Wow.

Kori Chilibeck:

Obviously, 500,000 school meals over a certain amount of time.

Then there were other projects happening such as solar panels, and some green-houses. So, the world programs got all these amazing projects that they sensibly pitched to us and we try to get involved as best we can with the funds that we have.

Rob Wallis:

And how did you get the relationship with the UN to create the partnership?

Matt Moreau:

Months upon months of phone calls and emails and sending out packages and concept ideas around what this company would stand for.

Thankfully, there’s a gentleman out in Ottawa who finally answered the call and showed some interest in what the concept of the company was and at the end of that first year, we were able to give a small $7,000 check. I think at that point it was ok. We’ve decided to see what we can do in the second year. In subsequent years we were just able to continue coming back with bigger and bigger checks.

The financial side of it is one thing, but the reality is we’re still really small company and the World Food Program works with partners like Vodafone, Pepsi and Kraft who are donating millions or tens of millions of dollars. So, we are able to help a little bit financially, but it’s also just the awareness around what we’re doing as well. We’re one of the only products in the world to bear United Nations logos. When someone walks in and buys a bottled water at IKEA, they turn the bottle over and they can start reading about the World Food Program. Samething happens in places such as Fairmont Hotels and The Four Seasons and really all across the country.

So, we’re able to do a big chunk of awareness for what they’re doing as well, which is equally important.

Rob Wallis:

So, do you have companies that seek to shop your products more now than five years ago, and how is the social enterprise landscape shifting demand and visibility of the Earth Group?

Kori Chilibeck:

I mean, when we started the Earth Group, the word “social enterprise” barely existed. That was just sort of very new to the landscape. In fact, we probably didn’t even call ourselves a social enterprise at the beginning, because I wasn’t even aware of what it was. Now, the world has changed quite a bit in this regard.

Well, I know the consumers are looking for companies that make a difference. As much as one really wants to pour Coke, Pepsi, Nestle, Unilever, they don’t really care about those companies. Giant, publicly traded companies that are just everywhere. So, there’s not really much of a choice.

When people walk into a Fairmont hotel or a Hilton Hotel and see the Earth Water and see this story – that differentiates that spot from what everybody else is doing. They realized that maybe that hotel cares about what’s happening on the planet and actually searched out a product that does something a bit better.

I think for a lot of years, we felt like we were a bit ahead of the wave. And now I feel like the world sort of catching up to what we’re doing and maybe understanding that people need to focus on products that are trying to do something good in the world because, to be honest, that’s really a way to make great changes. I’m hoping that we’re sort of hitting. We’re in the right place and at the right time where people are looking for these types of products.

Rob Wallis:

As individuals, how do you define success? Matt why’d you go first?

Matt Moreau:

I’ve got a young family of a 3-year-old and a 10-month-old. I hope that this company is around for 30 years from now and that we can do some incredible things as far as putting people into school, educating them, being very aware of our environmental footprints, finding ways to combat that and be able to do that. Hopefully, some of that kind of the kids can glean some things from that.

If I’m sitting here 30 years from now, looking back, I would hope that there’s some good successes there along the way. Kori and I are so lucky to have been able to speak at all sorts of events over the years, whether it’s Rotary clubs, churches, university groups or business associations and hearing from people…We just got a note into our website a week ago. Someone saying that the path that they’ve chosen to go into for both work and school was kind of heavily influenced by a talk that they heard from Kori and I gave about six years ago.

Making people aware that we as businesses have the power to change the world for the better and that we as consumers literally have the power in our pockets to change the destiny of someone’s life simply through everyday purchases, simply through something boring as a bottle of water – is pretty cool.

Kori Chilibeck:

I think Matt said a lot about the way I feel too.

If someone like Nestle ran the same way we do – we could solve world hunger in a matter of years.

So, maybe there’s the next big thing coming down the pipe that someone thinking about, heard us talk or saw our business model and said “hey, maybe I can work my company the same way” and next thing you know they turn that into a $10 billion company and we’re able to really make some huge changes.

From our own sort of success, from our company, it’s again just that number that we talked about at the beginning of the show. We want those meals to be up to 50 million meals, we want to have these crazy numbers out there that we’re really starting to move the needle and starting to help people.

It feels amazing to send 50,000 meals to someone, but it feels incredible when it starts getting to that million-meal range and start to really make some significant changes in people’s lives. That momentum is something hopefully we can capitalize on and maybe other companies seeing this will react as “they just did a million meals, let’s match that!” and will throw another million in there. Now we got 2,000,000 and sort of get the world a little bit galvanized around what people are trying to do. These small things make huge differences.

Rob Wallis:

Matt you’ve mentioned 30-year time horizon quite a few times in your answer. If we were sitting down in 30 years, what would you like the Earth Group to have achieved if we were looking back over those 30 years?

Matt Moreau:

Well, like Kori said, if we can get to the point where we call you and say we’re making a donation and it’s literally funding millions upon millions of meals for people. To have created legacy projects in certain countries around the world where we’ve been able to support them year after year. To have been able to do that with the support of certain companies. We worked with IKEA for six years now, let’s say we’re lucky enough to work with them for another 30 years, really trying to build some landmark programs for them where they know that every bottle of water that they sell is benefiting a certain project. Doing the same thing with the Fairmont’s and the Hilton’s being able to come to these companies with more than just a couple of products like we are today, whether that’s for the beverage products or food items, or who knows, tech ideas, apparel for sure. For example, every time we sell one of our hats, we can feed and educate a kid for a week.

It’s really about every product that we sell. We sell a case of water, we sell a bag of coffee – we have a certain dollar amount that goes to the World Food Program. Leading with that transparency that as a consumer or a corporation when you buy that from us versus the Coke, the Pepsi or the Nestle, here’s the change that we can create in the world.

Rob Wallis:

You mentioned somebody reached out to you after you spoke six years ago? When you talk to young people, what do you share with them and what do you think inspires them?

Kori Chilibeck:

We try to share as much as possible – just to do something you are passionate about. I know that’s bit cheesy, but the reality is if you love what you do, you’re probably going to be very good at it and you’re going to be happy. For most people, doing something they’re passionate about, probably something good, something that’s doing something positive in the world and doesn’t have to directly feeding children, but it can be all sorts of things that just make the world a little bit better place no matter what you’re doing. We try to convey that just go out there, be passionate, tenacious.

Matt and I’ve been told so many times, I can’t even count, that we should shut the company down, that it’s not a real company, it’s terrible idea, that we are going bankrupt, it’s awful, to get other jobs and move on.

And that’s happened a lot. Some very influential, successful people have told us that over the years and sometimes it shakes you a bit, but we’ve just been “Nope. This is what? This is the path. This is what we believe in, we have to go, we have to do it no matter what anybody says”.

And that’s another thing to tell young people. People are going to tell you not to do it or you can’t do it. That’s total BS. You can do anything you want.

If you believe in, and you are passionate about it – just honestly don’t give up until it’s over, and even then, it’s not over. We’ve been beyond over and still come back from the edge and build the company back again.

Rob Wallis:

You guys must have learned a lot of resilience over the years then.

Matt Moreau:

Resilience. Tenacity. We often would tell a story about how we approached IKEA for about four years. Anytime we’re in a major city, we go introduce ourselves at the store. We would send out handwritten notes, send out samples. And finally got a call back from someone said “Listen guys, please just leave me alone. We have a contract with Nestle..” but that two-minute call turned into 10 minutes and 10 minutes turned into 45 minutes. As we said earlier, now we’ve been working with them for multiple years and we’re talking about perhaps expanding to other countries outside of Canada.

As Kori said, “It’s never dead”. Even if it was a “no” on January 1st doesn’t mean it might not be a “yes” on June 1st. We just kept on calling and setting the reminders in the calendar and respectfully harassing people as much as possible.

Rob Wallis:

Totally. So, if you were to come do the journey again, would you have done anything differently?

Kori Chilibeck:

That’s a really good question.

Every time someone says, “oh, but maybe it wouldn’t be exactly where we are if we would have done things differently and learned the extremely tough lessons we learned along the way”, which are super important. Now when you look back and realize you’ve learned a lot. So, I don’t know if I would change anything. Maybe I would have got a better accountant and lawyer on the first day to give you a little bit better advice. But other than that…

Rob Wallis:

We’ve done a podcast on that recently too, by the way. Reference: Key Considerations to Make When Selling a Business.

Kori Chilibeck:

Yes, there’re two things to tell people when they’re starting a company: get some good accounting and legal advice. But beyond that, I can’t think of anything I’d want to change.

There have been some ups and downs, but most of the time it’s been up. What do you think Matt?

Matt Moreau:

I have to agree. It’s like you say, it all led us to where we are today and those horrible lessons, those bad, tough days where you don’t even want to get out of bed because you’re struggling that much. Like you said, Rob, it builds resiliency and brought us to where we are today.

I think that’s where, as Kori mentioned, you find something you’re passionate about. It makes it that much easier, when it’s just week after week of “no” or month after month of getting beaten down or whatever the latest incident is. If you’re incredibly passionate about it, there’s a way to drag yourself out and get back at it.

Rob Wallis:

Yes, absolutely. Does anything keep you guys up at night anymore, given what you’ve been through? Far from children.

Kori Chilibeck:

Far from family and kids… It seems like there’s always a fire burning somewhere that needs to be put out. It hits you on some random Tuesday afternoon that you weren’t expecting… Maybe don’t keep me up like they used to just because I know that Matt got my back, and we can and we’ve accomplished so much and going over some pretty terrible things. So, these things sometimes seem a little bit on the minor side when they come up and we… I’m optimistic all the time. At least on my end I still have some sleepless nights, but there maybe not as many as they used to be.

Rob Wallis:

So, in terms of wrapping up, could you explain to our listeners where they could find your products in Canada?

Matt Moreau:

You can find us in place like IKEA, Cobs, handful of Fairmont hotels, lots of hotels across the country. You guys are in Vancouver – the Vancouver Aquarium carries us.

We’ve been really lucky to start getting some phone calls from some major universities across the country lately, which five years ago never would have happened because they were completely locked up in Coke and Pepsi contracts. Places like Whole Foods. What am I missing?

Kori Chilibeck:

You are in Vancouver, so, Tacofino got it. Simon Fraser University has got some, especially in the student union building. I believe UBC started to put some in the SUB building now.

Lots of cafes and little restaurants are carrying our products. We are trying to focus on that type of stuff.

Matt Moreau:

And another thing is – if you head into a cool cafe, grocery store, whatever it is, and you don’t see our products it would mean a lot for a manager to hear from someone “Hey, did you know this product exists here?” We can make cold calls all day long, and generally speaking, people don’t want to talk to us because off the hop they just conceive or perceive us as a bottled water company, but we’re really not that. Bottled water happens to be one of the vehicles that we’re using to try to affect change. The coffee, the tea – are the same things. So, those warm introductions go a long, long way for us.

Rob Wallis:

Thank you, Matt. Thank you Kori. I really appreciate your time and your energy and your passion. Look forward to seeing you soon.

Kori Chilibeck:

Thanks for having us on.

Matt Moreau:

Thank you.